Call Now For Service!

Originally published: November 2025 | Reviewed by Kim Torres

Startup mediation in Austin is the fastest, most confidential way to resolve founder disputes over equity, IP, roles, and governance—without court.

Tech startups in Austin deal with unique challenges when founder relationships break down. The high-pressure world of building a company can turn a minor disagreement into a business-threatening conflict.

When co-founders clash over equity, roles, or direction, things can spiral fast. What started as a minor issue can quickly threaten the entire company.

Mediation gives Austin tech startups a way to resolve founder disputes quickly while keeping both the company and relationships intact.

Court battles can drag on for months (or longer), but startup mediation offers a faster, founder-focused solution that fits the tech world’s pace.

Austin’s collaborative business culture makes mediation especially well-suited for local entrepreneurs. Founders usually worry that any conflict resolution will sink their company or scare off investors.

Startup mediation in Austin helps founders resolve conflicts over equity, IP, and governance through structured negotiation instead of lawsuits, protecting both relationships and valuation.

Mediation is about talking, not fighting. A neutral mediator helps founders talk through their issues and find solutions they both can live with. There’s no winner or loser—just a fix everyone can accept.

Litigation means heading to court. That process can take years and cost a fortune. Judges make the final call, even if nobody walks away happy.

Arbitration sits somewhere in the middle. An arbitrator hears both sides and makes a binding decision. It’s faster than court, but someone still “loses.”

| Method | Timeline | Cost | Relationship Impact | Control | Confidentiality | Who Decides |

| Mediation | Days to weeks | $2,000–$10,000 | Preserves relationships | Founders decide | Private | Founders |

| Arbitration | Months | $10,000–$50,000 | Some damage | Arbitrator decides | Limited | Arbitrator |

| Litigation | 1–3 years | $50,000+ | Often destroys trust | Judge decides | Public record | Judge |

Austin’s collaborative entrepreneurial culture makes mediation especially powerful. Founders can get back to building, not bickering.

Legal fights eat up cash runway fast. Court cases can burn through $50,000 to $200,000 or more. That’s money better spent on building, not lawyers.

Team morale tanks when founders fight in public. Employees start updating their resumes. Key people leave when you need them most.

Investors lose confidence when disputes drag on. VCs want founders who solve problems, not create drama. Public legal messes make fundraising a nightmare.

Mediation usually costs $2,000 to $10,000 total. Most disputes wrap up in days or weeks—not months. The company stays focused on business, not legal distractions.

Confidentiality protects your reputation. Mediation happens behind closed doors. Lawsuits go on the public record, which can haunt your startup’s image with customers and future investors.

Cost & Time Reality Check (Austin Startups)

Austin’s tech scene has its own set of conflict patterns between founders. Equity disputes pop up when founders leave or underperform. IP ownership gets messy when contractors contribute code or open-source libraries mix into proprietary systems.

Most Austin founders split equity equally at the start, without really considering future contributions. Trouble starts when one founder leaves or stops pulling their weight.

Cliff periods protect companies from founders who bail early. Four-year vesting with a one-year cliff means someone who leaves before 12 months gets nothing.

Acceleration triggers are a hot-button issue. Single-trigger acceleration gives all equity after a sale or merger. Double-trigger requires both a sale and a founder termination.

Common equity disputes include:

Many partnership and co-founder fights start with unclear equity deals made in the early, excited days.

Intellectual property ownership creates messy disputes in Austin’s collaborative tech world. Founders use contractors, open-source libraries, or contribute code before formal IP assignments exist.

Contractor code ownership gets tricky as companies scale. You need work-for-hire agreements before development starts. Without them, contractors might keep rights to the code they wrote.

Open-source compliance can bite you if proprietary code mixes with GPL or other restrictive licenses. This might force a company to release its entire codebase or face lawsuits.

Key IP dispute areas include:

Founders should document all code contributions and sign IP assignment agreements right after incorporation. Don’t wait.

Roles blur as Austin startups grow from two people to full teams. Technical founders often struggle to move from coding to managing.

CEO vs CTO fights pop up when technical founders want to stay involved in product while business founders push for more delegation. Clear roles help prevent turf wars.

Performance measurement gets messy when founders set different priorities. Tech-focused founders care about code quality; business-focused founders chase user growth or revenue.

Performance disputes usually look like:

Regular reviews and clear KPIs help keep these issues from blowing up the partnership.

Funding rounds create tension between founders with different risk appetites and compensation needs. SAFE notes and convertibles make ownership math even messier.

Salary vs equity trade-offs split founders with different financial realities. Founders with families may want higher wages. Single founders might take lower pay in exchange for more equity.

Dilution protection gets important as you raise more rounds. Anti-dilution clauses can shift ownership a lot during down rounds or bridge loans.

Common compensation disputes include:

Understanding the cap table math early helps founders avoid nasty surprises during fundraising.

Governance often breaks down when Austin tech companies shift from informal partnerships to investor-backed structures. Equal ownership splits can deadlock important choices.

Board composition fights break out when founders can’t agree on investor reps or independent directors. Odd-numbered boards stop ties but might not match ownership percentages.

Voting agreements matter for keeping founder control. Drag-along and tag-along rights affect how and when founders can exit or block sales.

Deadlock resolution tools include:

Business dispute resolution helps founders avoid costly lawsuits while maintaining working relationships.

Torres Mediation supports Austin tech startups facing partnership challenges, offering a faster path to resolution without court battles. Keep your team aligned—Contact us now.

If you’re ready to get started, call us now!

Startup mediation compresses conflict resolution into focused sessions that identify issues, test trade-offs, and produce a signed term sheet within days.

The preparation phase lays the groundwork for real negotiation. Each side submits a confidential brief outlining their position and what they want from the process.

Essential documents usually include:

Keep the brief short—just 2-3 pages max. Anything longer tends to bog things down and bury the main points.

Decision-maker attendance isn’t up for debate. Founders, key investors, or board members with real authority need to be in the room.

Startup mediation specialists know that sending someone who can’t make decisions just wastes everyone’s time.

The mediator reviews everything 48-72 hours before the session. This gives them a chance to spot any common ground—or trouble spots—right away.

The joint session brings everyone together to set ground rules and clarify objectives. Each side gets to present its take in a structured way.

The mediator helps the parties determine their BATNA (Best Alternative to a Negotiated Agreement) for startups, which often means facing litigation, business disruption, or even the company’s shutdown.

Common startup goals look like:

Sessions usually last 2-3 hours. It’s surprising how often people realize they actually want similar things.

The mediator keeps the discussion focused on business outcomes, not personal drama. That’s usually the only way to keep things productive.

Private caucuses give each party a chance to talk with the mediator, one-on-one and off the record. These sessions often uncover the real concerns and open the door to creative solutions.

The mediator will reality-test each party’s stance. They push founders to honestly assess the costs and risks of walking away rather than settling.

Typical trade-offs in startup disputes:

Startup mediators know the ins and outs of vesting schedules, dilution protections, and board seats.

Caucuses usually last 45-90 minutes per party. The mediator moves between rooms, nudging everyone toward a deal.

This is where breakthroughs often happen. People can float ideas they’d never say in front of the whole group—nobody wants to lose face.

When everyone’s on board in principle, the mediator helps put the terms into a binding memorandum. This step keeps deals from unraveling during final paperwork.

The memorandum covers the essentials:

Startup-specific terms:

Everyone signs before leaving the mediation. That way, the deal can’t fall apart overnight.

Most memoranda run 3-5 pages. If the deal’s complicated, you might need more paperwork within 30 days, but the main terms get locked in right away.

Mediation in Austin usually costs between $2,000 and $8,000 per dispute. Most startup cases wrap up in 1-3 sessions.

If you’ve got an emergency, mediators can jump in within 48 hours. Messy partnership splits might take several weeks and multiple sessions to resolve.

Austin mediators tend to charge flat rates rather than hourly. Half-day sessions run $1,500-$3,000; full-day sessions are $2,500-$5,000.

Common Fee Arrangements:

Mediators usually want 50% upfront, with the rest due after the session. Some will do payment plans if your startup’s tight on cash.

Admin fees range from $200 to $500 for document work and follow-up. Going virtual can knock 15-20% off, since there’s no venue to pay for.

Emergency mediation can happen within 48 hours if the business is on the line. These rush jobs cost 25-50% more.

Simple disputes might wrap up in one 4-8-hour session. Tougher partnership breakups usually need 2-3 sessions, spaced out over a week or two.

Typical Timelines:

Staged sessions work best for emotional disputes. They give people time to process and avoid snap decisions that everyone regrets later.

Mediation saves you from the nightmare of litigation, which can cost $50,000-$200,000 per party. Discovery alone often runs $15,000-$40,000 just in lawyer fees and paperwork.

Employee turnover during public fights costs startups $25,000- $75,000 each time a key engineer or team member walks out. Mediation keeps things private and the team intact.

PR fallout from founder lawsuits can wreck investor trust and scare off customers. Startups dodge the $10,000-$30,000 per month in reputation management bills during a crisis.

Avoided Expenses:

Business keeps running during mediation. That means you don’t lose revenue because everyone’s distracted by a lawsuit.

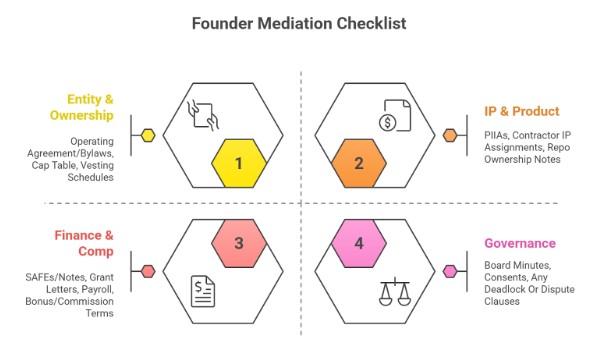

Good founder mediation needs a complete set of legal and financial documents for the startup. Mediators want to see clear proof of who owns what, IP rights, finances, and how decisions get made.

| Category | Documents You’ll Need | Why It Matters |

| Entity & Ownership | Operating Agreement / Bylaws, Cap Table, Vesting Schedules | Defines voting rights, ownership percentages, and vesting terms; resolves disputes over dilution, exits, or unvested shares. |

| IP & Product | PIIAs, Contractor IP Assignments, Repo Access Logs, Patent/Trademark filings | Clarifies who owns code, inventions, and trademarks; avoids disputes over contractor work, open-source, or pre-incorporation IP. |

| Finance & Compensation | SAFEs/Convertible Notes, Grant Letters, Payroll Records, Bonus/Commission Plans | Shows equity commitments, deferred comp promises, and actual pay; resolves salary gaps, dilution, and investment triggers. |

| Governance | Board Minutes, Written Consents, Deadlock/Dispute Clauses, Voting Agreements | Documents decision-making history; provides rules for breaking ties or triggering mediation; ensures board approvals are valid. |

The operating agreement or bylaws spell out each founder’s rights, duties, and voting power. Get the current version—drafts from last year won’t cut it.

Austin startups tweak these docs all the time, so make sure you’ve got the latest amendments.

The cap table lays out exactly who owns which slice of the company. This becomes a big deal when founders argue about equity splits or dilution from new investors.

Key cap table details:

Vesting schedules show when founders truly own their shares. If someone leaves early, they might lose unvested equity, and that sparks plenty of arguments.

Standard vesting docs should cover:

IP fights can tear a startup apart faster than almost anything else. Solid mediation prep means having all your IP paperwork in order.

Proprietary Information and Invention Assignment Agreements (PIIAs) specify who contributed what and transferred it to the company. These usually cover inventions made before, during, and after working at the startup.

Missing or half-baked PIIAs leave big questions about who really owns the tech—especially if founders built things before the company officially launched.

Contractor and consultant IP assignments prove the company owns the work done by freelancers. In Austin, lots of startups hire outside devs early on.

Repo ownership notes record who wrote which code and when. GitHub history, Slack chats on product decisions, and technical docs all help make your case.

Critical IP docs:

Money disputes between founders usually come from fuzzy comp plans or unclear investment terms. Bring complete financial documents so the mediator can see what each side submitted and what they expected in return.

SAFE agreements and convertible notes outline terms for external investment, which can affect founder equity. These often have triggers if someone leaves or the company sells.

Deferred comp is a headache when founders work for free early on. Even informal grant letters help document promises about future pay or equity.

Payroll records show what founders actually got paid versus what they thought they’d get. Lots of Austin startups start with uneven salaries, which can lead to long-term resentment.

Bonus and commission plans need to be in writing. Verbal promises about payouts after hitting milestones or landing big clients? Those always turn into disputes later.

Essential financial docs:

Board docs show how founders made big calls and whether they followed the rules. Disputes often arise when people skip agreed-upon governance steps.

Board meeting minutes record votes on moves such as hiring executives, raising capital, or changing direction. If minutes are missing, it usually means decisions happened off the books—which can break the agreement.

Written consents prove board decisions made outside formal meetings. They show everyone signed off on major actions.

Deadlock clauses spell out what happens when founders can’t agree. Many operating agreements have step-by-step processes for breaking these logjams.

Dispute clauses may require mediation before anyone sues. Knowing what’s in these sections helps shape the mediation from the start.

Key governance docs:

If you’re ready to get started, call us now!

When founders clash, the right contract terms can restore balance—without sinking the company.

These model terms address the four main areas where most fights flare up and outline real, practical paths to resolution.

Equity fights usually start when founders leave early or just don’t deliver. Solid founder agreements bake in ways to deal with this, aiming for fairness (or as close as you can get in a tense moment).

Buyback Options give the company the right to buy out a departing founder’s vested shares at market value. Typically, there’s a 90-day window to exercise this, plus an outside valuation to keep things honest.

Revesting schedules reset the equity clock if a founder returns after a dust-up. Companies often go with a new four-year vesting schedule with a one-year cliff. It’s a reset button—protection if someone bails again, but a second chance if they stay.

Earn-out structures tie any remaining equity to hitting clear milestones—revenue, product launches, fundraising, whatever matters most. This tends to work well if founders can’t agree on where the company should go next.

Performance tranches slice up equity based on what each person actually delivers. The technical founder may get more for shipping the product, while the business founder gets bonuses for landing sales. Laying out these metrics up front heads off those “who did what” arguments later.

IP confusion is a classic founder fight. If you don’t spell out who owns what, you’re just asking for trouble.

Retroactive assignments hand over all IP created by founders to the company, from day one—sometimes even before the company officially exists. This covers code, designs, business methods, customer lists, you name it.

License-back provisions let departing founders use shared tech in new gigs, but with strict limits. Usually, these deals spell out exactly what they can do, where, and for how long, to avoid direct competition.

IP escrow arrangements stash critical code, patents, or trade secrets with a neutral third party during disputes. Who gets what depends on the outcome of the dispute resolution.

Founders need to keep detailed invention logs and do regular IP audits. Everyone should disclose any prior work or obligations to other companies, or you’ll have messes later.

Founders’ power struggle when roles aren’t clear. You can’t just wing it—clear definitions and real accountability matter.

Title and scope adjustments align job titles with what people actually do. The technical co-founder may move from CEO to CTO. Detailed job descriptions reduce overlap and confusion.

KPI scorecards track what each founder accomplishes each month. Revenue, product milestones, building the team, fundraising—whatever’s important. These regular check-ins spot issues before they blow up.

Decision rights matrices spell out who decides what. Big calls need everyone to agree, but day-to-day stuff sits with whoever owns that role. The board steps in only for major issues to avoid deadlocks.

| Decision Type | Authority Level | Approval Required |

| Budget under $10K | Individual founder | None |

| Hiring decisions | Relevant department head | Co-founder consensus |

| Major partnerships | CEO | Board approval |

| Equity changes | N/A | Unanimous founder + board |

When founders fight, the company’s reputation takes a hit if you don’t handle it right. A structured comms plan keeps everyone calm and in the loop while you work things out.

Employee messaging addresses team worries without spilling confidential details. Use standard talking points about leadership transitions as growth moves. HR should prep FAQs for the most common questions.

Board communications need to be clear and honest about what’s happening and how long it’ll take to resolve. Regular updates prevent panic moves or board overreach. Legal should check every board deck before it goes out.

Investor relations should focus on business continuity and hitting milestones. Frame disputes as just part of growing up, not as signs of doom. Investor updates are about keeping funding doors open.

Customer outreach is all about reassuring big accounts that service won’t slip. Account managers should get in front of clients early. Watch those SLAs and delivery dates extra closely until things settle down.

Pick a spokesperson and stick to the script. Don’t let mixed messages leak out—run all external comms through the agreed channels until the dust settles.

| Issue | Settlement Term (Plain English) |

| Unvested equity | Buyback within 90 days at fair market value |

| Co-created IP | Retroactive assignment with a limited license-back |

| CEO/CTO conflict | Role reset with KPI scorecard |

| Board deadlock | Odd-numbered board or tie-breaker protocol |

In the heart of Austin’s tech scene, Torres Mediation provides practical solutions to founder-investor conflicts. Don’t let disputes stall growth—Schedule your appointment.

If you’re ready to get started, call us now!

Austin startups have their own IP headaches, especially with remote teams, open-source code, or AI tools in the mix. Standard agreements often miss these messy, modern issues.

Remote teams can turn legal matters into a nightmare, especially when people work across state lines. Different state laws decide who owns the code, and that’s a mess waiting to happen.

Jurisdiction Problems:

The biggest trap? Contractor agreements. Austin founders often think their contracts automatically transfer IP, but that’s not true if the contractor is in a state with different rules.

Remote teams face evolving challenges in code ownership that require thoughtful legal planning. Texas law just doesn’t reach out-of-state workers.

Critical Documentation Needed:

Mediation gets tricky fast when team members live all over. Mediators need to know how different state laws will affect who owns the IP before they can help settle things.

Open-source software can sneak legal landmines into Austin startups. Developers sometimes add libraries without checking licenses, and that can blow up during founder disputes.

Common License Traps:

Startups often find OSS violations only during due diligence or when partners start digging. Founders might argue over who owns code that’s actually tied to a copyleft license.

It gets worse if different team members use conflicting licenses. One person might add GPL code, another might use Apache, and suddenly, ownership is a tangled web.

Risk Factors:

Settlement deals have to address what to do about existing OSS violations. Sometimes, mediators help founders decide whether to open-source the code or just rewrite the problematic parts.

AI coding tools like GitHub Copilot are turning code ownership into a real headache for Austin startups. When AI spits out code, the old rules just don’t fit anymore.

Legal fights over AI-generated code ownership are already popping up. Courts haven’t really figured out who owns AI-assisted code yet.

Key Ownership Questions:

IP ownership of AI-generated code raises tough authorship questions that old work-for-hire rules just don’t answer.

Training data only makes it messier. AI models learn from codebases that might include proprietary or copyrighted stuff, so startups using AI-generated code could be on the hook for liability.

Settlement Considerations:

Mediators need to help founders set policies for using AI tools. Contract terms with AI vendors can decide who owns what, so reviewing those agreements is a must during settlement.

The right people at the table can totally change a mediation session. Too many voices? Chaos. Miss the key decision-makers? Nothing happens.

Founders have to show up for their own mediation. They know the business, and only they can make the calls that matter in the moment.

The founder’s job is to:

Attorneys act as advisors and translators for legal stuff. They shouldn’t take over or talk for their clients the whole time.

Lawyers should:

Plenty of founders worry about saying the wrong thing and let lawyers do all the talking. But mediation works best when the actual people in conflict speak for themselves.

The mediator needs to hear from the real folks, not just their reps.

Board members and investors should only join if they have veto power over solutions. Sometimes they speed things up; other times they just add pressure.

Include investors when they:

Keep investors out when they:

One trick: pre-brief key investors before mediation. Share the basics, get their input on what’s okay, and set boundaries.

This way, founders know what deals investors will actually sign off on before they make promises.

Some mediators allow investors to join by phone to review the final agreement. That keeps them involved but stops them from running the show.

Technical disputes really do need technical experts. But if you pick the wrong expert, you can tilt the whole process toward one side’s view.

Subject matter expert neutrals work best for:

The mediator should choose these experts, not the parties. That way, neither side can just find someone who’ll say what they want to hear.

Good SME neutrals have:

These experts don’t decide the law. Instead, they clarify technical facts that both sides can agree on.

Say you’re arguing over machine learning algorithms—an AI expert could explain whether the two actually compete. With that shared understanding, founders can focus on business solutions instead of endless technical debates.

The expert should present the findings to both sides simultaneously. Meeting privately with one party ruins the neutral balance that makes mediation work.

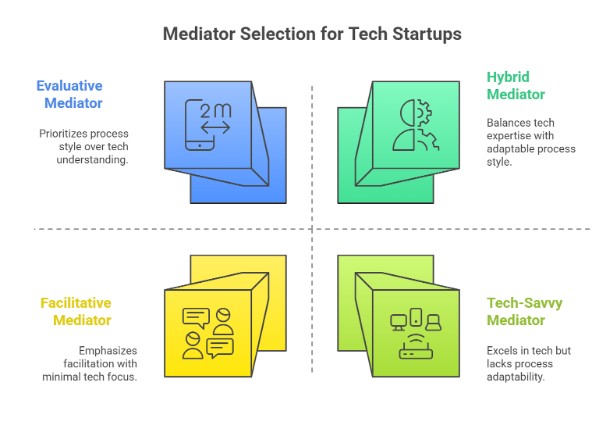

Getting the right mediator can totally change your startup’s dispute resolution outcome.

The best mediators understand how venture capital works, handle tricky IP issues, and know when to adapt their style to your specific conflict.

Tech startups run into disputes that most business mediators just don’t get. You need someone who really speaks the language of VC deals and startup structures.

Look for mediators who understand cap table disputes between founders and early employees. They should get how equity dilution works and why vesting schedules matter when partnerships hit trouble.

Intellectual property knowledge is huge here. Austin mediators specializing in IP and technology disputes can resolve ownership disputes over code, patents, and trade secrets.

Data privacy and open-source licensing often spark conflicts among startups. Your mediator should know about GDPR compliance and GPL license headaches—these things kick off co-founder fights all the time.

SAFE note complications need someone who’s been there before. Plenty of mediators just don’t get how Simple Agreements for Future Equity convert when founders and investors lock horns.

Not every mediation style fits every startup conflict. Knowing the difference helps you avoid a mismatch.

Facilitative mediation is great for relationship-driven disputes. The mediator helps founders talk it out, without giving legal advice. It’s the way to go when you still have to work together afterward.

Evaluative mediation works for gnarly IP or equity fights. Here, the mediator weighs in on legal positions and what a court might do. Sometimes, founders just need a reality check to move forward.

Hybrid approaches mix the two. Austin business mediators who offer flexible processes can switch gears as the situation demands.

Early-stage founder disputes? Facilitative usually helps. When partnerships break down later, evaluative input often settles things.

Asking the right prep questions can save your startup a ton of time and money. Don’t be shy about the specifics of logistics and how the mediator prepares.

Availability matters in urgent startup disputes. Ask if they handle emergencies or work weekends. Some Austin mediation services offer accelerated timelines for business crises.

Preparation requirements vary a lot. Find out if the mediator looks at your cap table, employment agreements, or IP assignments before day one.

Ask about confidentiality templates and NDAs. Startups have to protect their secret sauce during mediation, no question.

Fee structures should be straightforward. Some mediators bill by the hour, others charge flat rates. Get a written estimate—including prep and any follow-up work.

Ask for references from other tech companies they’ve helped. Austin’s startup scene is small, so you can usually check their track record with local founders or investors.

Torres Mediation brings real small-business know-how and fits right into Austin’s collaborative vibe.

They aim for same-day agreements and keep things confidential, whether you want to meet in person or online.

Torres Mediation gets what Austin tech startups are up against. They’ve seen all the usual founder disputes—equity splits, who gets to make decisions, and what happens when someone wants out.

The firm knows that startup conflicts often come from fuzzy agreements made in the early, exciting days. Their mediators help founders separate personal feelings from business choices.

Key areas of expertise include:

Austin’s collaborative entrepreneurial culture makes mediation particularly effective for resolving local small-business conflicts. Torres Mediation uses this to get people talking and actually working things out.

Their mediators stay neutral but really understand both the technical and business sides of running a startup. That combo helps them spot practical solutions everyone can live with.

Torres Mediation wants to get you to a real agreement fast—not drag things out. Their goal is a clear term sheet covering the main points, usually in a single session.

This keeps disputes from festering and lets founders get back to building their companies. Nobody wants to get stuck fighting forever.

The process usually looks like this:

When you reach an agreement, Torres Mediation hands things off to your lawyers for the formal paperwork. They work with attorneys to ensure your deal becomes a real contract.

The firm knows plenty of Austin business lawyers who get startups. That network helps make the move from mediation to legal docs way smoother.

Mediation sessions stay confidential under Texas law. If mediation doesn’t work out, nothing you say here can be used against you in court later.

Torres Mediation offers virtual and in-person options. That way, founders with packed schedules can still make it work.

Virtual sessions are invaluable when co-founders live in different cities—or even different time zones.

Session format options:

The team sets up virtual breakout rooms so each party can talk privately. Mediators often get a clearer sense of what matters most to each person this way.

Confidentiality also covers every document shared during mediation. Founders can raise financial or personal concerns without worrying about leaks.

Torres Mediation helps Austin founders resolve partnership disputes quickly and confidentially, so you can focus on scaling your startup. Protect your vision—Contact us today.

What is tech startup mediation in Austin?

Tech startup mediation in Austin is a confidential process in which a neutral mediator helps co-founders, partners, or investors resolve disputes (such as equity splits, IP ownership, or governance disagreements) outside of court.

When should an Austin tech startup consider mediation?

A tech startup in Austin should consider mediation when disagreements among founders, partners, or investors begin to impede decision-making, delay product launches, drain resources, or threaten key relationships.

How much does mediation cost for Austin tech startups?

While costs vary, Austin tech startup mediation typically costs significantly less than litigation. Many mediators charge a flat half-day or full-day rate, split between parties. Hidden costs (legal fees, discovery, lost productivity) are lower.

What issues do Austin tech founders commonly resolve via mediation?

Founders in Austin tech startups often mediate disputes involving:

How long does mediation take for tech startup disputes?

In Austin, mediation for tech startup disputes often concludes in a single session (4–8 hours) or over one full day when well-prepared. More complex cases may require follow-up sessions. Compared to months or years of litigation, mediation provides a much faster path to resolution.

Is a mediated agreement enforceable for a startup?

Yes — a properly drafted mediated agreement (often a Memorandum of Understanding or Settlement Agreement) is legally binding in Texas if both parties sign it and relevant formalities are met. It allows the startup to move on with clarity on roles, ownership, IP, and governance.

How do you choose the right mediator for an Austin tech startup?

To pick the right mediator in Austin for a tech startup, look for:

Can we mediate if we have already filed a lawsuit?

Yes. Courts in Texas often pause ongoing cases to allow mediation, giving startups a faster, more cost-effective path to resolution while avoiding prolonged litigation.