Call Now For Service!

Originally published: October 2024 | Updated: October 2025 | Reviewed by Kim Torres

Getting divorced without an attorney in Florida might save you thousands in legal fees. However, the financial side of things can become complicated quickly, so you need a solid plan and at least a basic understanding of state laws.

Florida law requires specific financial disclosures during divorce, like tax returns, bank statements, and property deeds. If you make these mistakes, you risk incurring expensive errors.

The 2023 alimony reforms and updated child support guidelines have altered how courts assess financial matters in Florida divorces. Even if you think you’ve got it figured out, double-check those new guidelines before you file.

Many couples opt for the pro se route to maintain control and save money. But, they often don’t see the financial traps coming—and those can cost more than a lawyer would have.

Property division in Florida follows equitable distribution laws. That doesn’t always mean a clean 50-50 split, so you’ll want to know the rules to protect yourself.

Financial planning during a Florida divorce encompasses both short-term expenses, such as filing fees, and long-term considerations, including retirement accounts.

If you prepare and know your rights, you can handle your own divorce and still look out for your future.

A Pro Se Divorce In Florida Means Filing And Managing Your Divorce Without An Attorney, Requiring Spouses To Handle Disclosures, Property Division, And Support Obligations On Their Own

Pro se divorce means you’re handling the divorce proceedings yourself, without the involvement of a lawyer. Florida courts also refer to it as a self-represented divorce.

Both spouses have to file their own paperwork with the court. You’re responsible for obtaining legal forms, meeting deadlines, and attending court proceedings.

Key responsibilities include:

The court treats pro se litigants just like folks with lawyers. Judges expect you to follow every rule and procedure, no exceptions.

If you make mistakes on forms or miss deadlines, the divorce can drag on or cause legal headaches. Florida courts offer a few self-help resources, but don’t expect legal advice from them.

Florida family courts let you represent yourself in a divorce. Pro se works best if your finances are straightforward.

You will need to learn Florida divorce laws and court procedures independently. That means knowing which forms to file and when to file them.

Common court requirements:

Judges won’t help you with your case. Court clerks can explain procedures, but they can’t give legal advice or fill out your forms.

You must research Florida statutes and local court rules independently. Understanding concepts like equitable distribution and time-sharing for children is your responsibility.

The process becomes more complicated if you and your spouse disagree over significant issues. Property disputes, custody battles, or support disputes often require more extensive legal expertise and increased court time.

Pro se divorce can save you a lot on lawyer fees. You also get more control over your case and timeline.

Advantages:

Disadvantages:

The biggest risk? Costly legal errors. You could agree to a nasty property split or not get the support you need.

An uncontested divorce is usually safer for those representing themselves. If you and your spouse agree on the big stuff, things go smoother and you avoid a lot of risk.

Take control of your Florida pro se divorce with Torres Mediation—clear guidance, fair financial solutions, and cost savings without court battles. Schedule today.

If you’re ready to get started, call us now!

Florida Requires Both Spouses To Exchange A Family Law Financial Affidavit Within 45 Days Of Filing, Detailing Income, Assets, And Debts

Both sides fill out a family law financial affidavit under Florida’s disclosure rules. You have to do this in every divorce, even if you agree on the money stuff.

The 45-day clock starts when you file the divorce petition. Each spouse has to lay out their complete financial picture for the other within that window.

The affidavit lists every source of income, including wages, business income, rent, and investments. You also need to list every asset, including real estate, cars, bank accounts, retirement funds, and other similar items.

All debts are included on the list, including credit cards, mortgages, student loans, and personal loans. If you took out a loan before getting married and still owe money, it must be disclosed.

Everyone has to do this, whether you file together or separately. Pro se filers can’t skip it, even for an uncontested divorce.

Florida’s family law forms give you two versions of the financial affidavit. Form 12.902(b) is the short one; 12.902(c) is the long version.

Short Form 12.902(b) fits if:

Long Form 12.902(c) is for:

The short form’s simpler, with fewer sections. It just covers basic income, expenses, assets, and debts.

The long form digs deeper. You’ll have to detail business interests, investment accounts, and break down expenses more thoroughly.

Both forms need your signature under oath. Lying on them is perjury, which is a criminal offense—so don’t fudge the numbers.

The 45-day deadline for financial disclosure is strict in Florida. If you don’t provide full disclosure, you can expect delays or even court penalties.

Penalties for not complying include:

Courts won’t move your case forward until both people finish their disclosures. That means your divorce could stall for months.

Judges can make you pay the other side’s attorney fees if you don’t meet deadlines. Sometimes, those fees get expensive—think thousands, not hundreds.

If you really blow it, the court can enter a default judgment. That means your spouse could get everything they asked for in their petition, and you’re left with nothing.

Florida law requires individuals to provide specific financial disclosures during divorce proceedings. These disclosures include tax returns, bank statements, and property deeds.

The complete list covers 16 categories of documents. It’s a lot, and honestly, it can feel overwhelming at first glance.

Required income documentation:

Asset documentation includes:

Debt verification requires:

You may also need to review insurance policies, business financial records, or investment account statements. Courts expect you to back up every asset and debt you list on your financial affidavit.

Leaving out financial information can create serious problems. These documents show each spouse’s assets, debts, income, and expenses.

They’re crucial for determining alimony, child support, and how to divide property. If one spouse hides assets and the court later discovers it, things can escalate quickly.

Judges sometimes award the entire hidden asset to the honest spouse as a form of punishment. Child support calculations go off the rails if income isn’t fully disclosed.

That can lead to more court hearings down the road. If you don’t list all assets, the court can’t divide them, which is unfair.

Judges remember when someone withholds information. That hurts your credibility and could affect future rulings.

Long-term consequences include:

Florida Courts Start With A 50/50 Division Of Marital Property But May Adjust Based On Fairness Factors Under §61.075.

Florida follows equitable distribution principles. Courts begin with the idea of splitting marital assets equally, but that’s just the starting point.

Judges can adjust the split if the facts warrant it. Florida Statute § 61.075 outlines the rules for these decisions.

When a judge chooses an unequal split, they must provide a written explanation for their decision. That way, everyone knows how the court reached its decision.

Key factors that influence distribution include:

Marital property encompasses assets acquired during the marriage, regardless of whose name is on the title. That means income, homes purchased together, retirement savings, and even businesses started during the marriage.

Non-marital property stays with whoever owned it before the marriage and includes:

Common examples of marital property:

Property can change classification if you mix non-marital money with marital funds. For example, depositing inheritance into a joint account may make it marital property. It’s easy to blur those lines without realizing it.

Judges examine the details when deciding whether a split should remain 50/50 or shift. They need evidence presented at trial to support any unequal division.

Financial misconduct can tip the scales. If someone wastes marital funds or conceals assets, the judge may award the other spouse additional compensation to even things out.

Contribution factors the court examines:

Economic circumstances matter, too. Judges consider earning potential, age, health, and what each person will need after the divorce.

The duration of marriage affects results. Longer marriages usually lead to more equal splits, while short marriages might favor the higher earner.

Example 1: Standard Equal Split

A couple, married for 15 years with $300,000 in marital assets and no complicating factors, will each receive $150,000.

Example 2: Unequal Due to Misconduct

If one spouse gambled away $50,000, the court might award the innocent spouse an additional $25,000 to compensate for half the loss.

Example 3: Career Sacrifice Consideration

A spouse who stayed home for ten years to raise children could receive 60% of the retirement assets to compensate for lost earning power.

Example 4: Short Marriage with Individual Assets

In a three-year marriage where one person brought most of the assets, the court typically focuses on what was acquired during that period.

Business valuation scenarios get tricky. If one spouse built a business during marriage, an expert might appraise it, and the other spouse could get other assets to balance things out.

| Aspect | Marriage | Cohabitation |

| Property Division Rights | Equitable distribution applies | No automatic division rights |

| Asset Protection | Both spouses have claims to marital property | Assets remain with the original owner |

| Retirement Accounts | Subject to division via QDRO | No division rights |

| Real Estate | Marital property, regardless of title | Ownership follows the deed |

| Bank Accounts | Joint accounts presumed marital | Individual accounts remain separate |

| Business Interests | Increases during marriage are marital | No automatic interest |

| Legal Process | Court-supervised division | Contract or partnership agreements only |

| Debts | Both spouses are responsible for matrimonial debts | Individual liability only |

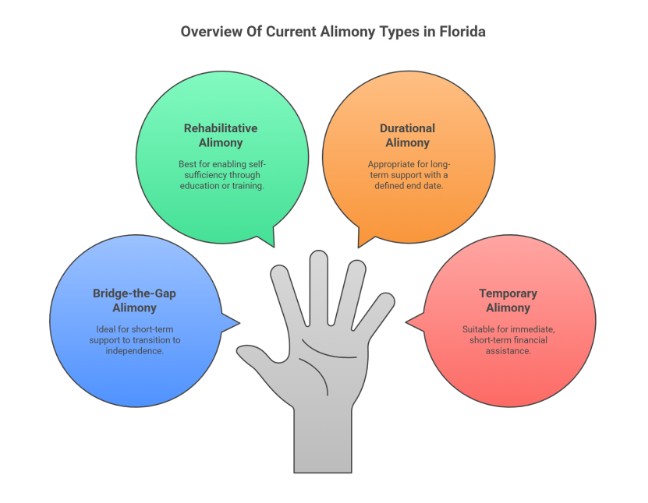

Florida Abolished Permanent Alimony In 2023, Limiting Awards To Bridge-The-Gap, Rehabilitative, And Durational Alimony Based On Marriage Length

Florida changed its alimony laws in 2023, ending permanent alimony awards. Courts can’t order lifelong spousal support anymore, no matter the circumstances.

The three main types now serve different purposes. Bridge-the-gap covers short-term needs. Rehabilitative alimony helps someone get education or job training. Durational alimony provides ongoing support for a specified period.

This change applies to all divorce cases filed after July 1, 2023. If you already have permanent alimony, it remains in effect unless a judge changes it later.

Bridge-the-Gap Alimony lasts up to two years, max. It’s there for immediate expenses, such as moving costs or job searches. Once ordered, you can’t extend or modify it.

Rehabilitative Alimony supports education or job training. The spouse requesting it needs to demonstrate a clear plan and timeline. Courts can change it if circumstances shift a lot.

Durational alimony provides support for a specified period. The new law establishes time limits based on the duration of the marriage. Judges cannot exceed those caps.

Temporary Alimony only covers the time during the divorce proceedings. It ends once the final judgment is entered.

Marriage length controls how long alimony can last under Florida’s new rules:

| Marriage Length | Maximum Duration |

| Less than 3 years | No alimony available |

| 3-10 years | 50% of the marriage length |

| 11-20 years | 60% of the marriage length |

| Over 20 years | 75% of the marriage length |

The law caps payments at 35% of the income difference between spouses. Judges figure this out by subtracting the lower earner’s net income from the higher earner’s net income.

So, if one spouse makes $8,000 per month and the other brings in $3,000, the most alimony allowed would be $1,750 a month ($5,000 × 35%).

Courts look at each spouse’s financial resources and the standard of living during the marriage. Judges check both current income and earning potential.

Career sacrifices can significantly impact alimony decisions. If one spouse has given up education or career growth for the sake of the family, courts definitely consider that.

Age and health play a role in each spouse’s ability to work and support themselves. Judges often show more consideration to older spouses or those with health issues.

Childcare responsibilities can limit earning capacity. Parents caring for young children might not have many work opportunities.

Education and job skills affect how quickly someone can become self-supporting. Sometimes, courts recognize that additional training or education is necessary.

Mediation gives couples more flexibility than what the court might order. Spouses can work out terms that fit their unique situation, as long as they stay within legal boundaries.

Lump-sum payments can wipe out ongoing monthly obligations. This works best when one spouse has assets but not much steady income.

Property trade-offs sometimes replace alimony payments. One spouse might keep the house or a retirement account instead of getting monthly support.

Step-down schedules reduce payments gradually over time. This helps the receiving spouse adjust while giving everyone a clear timeline.

Income-based adjustments link alimony to an individual’s actual earnings, rather than just their potential earnings. That way, if jobs change suddenly, both sides have some protection.

Simplify your financial disclosures and property division. Torres Mediation helps Florida couples resolve pro se divorce issues privately, affordably, and on their own terms. Contact us now.

If you’re ready to get started, call us now!

Florida Uses The Income Shares Model, Combining Both Parents’ Incomes To Determine A Guideline Support Amount

Florida child support calculations rely on a structured system based on the Income Shares Model. The idea is that children should receive the same financial support they would’ve had if their parents had stayed together.

The model adds up both parents’ gross monthly incomes. The court uses this combined number to find the total child support amount from Florida’s guidelines table.

Once they have the total, the court splits it between the parents according to their income share. The higher earner usually pays a bigger portion.

So, if the father earns 70% of the total income, he pays 70% of the guideline support. The mother covers the other 30%.

Florida’s child support formula requires specific information to calculate the numbers accurately. Parents have to list their gross monthly income from all sources.

Required Income Information:

The number of overnight stays matters, too. Parents with more than 73 overnights a year can get credit that lowers their obligation.

Childcare costs for work or school add to the basic support amount. The person who pays those expenses receives credit in the calculation.

Health insurance premiums for the kids also count. The parent paying for insurance gets credit for those costs.

Parents can use the official Child Support Guidelines Worksheet, Form 12.902(e), to determine support. This form was updated in June 2025 to reflect the latest rules.

The worksheet guides parents through every step. It has spots for income, overnights, and extra expenses.

Many family law attorneys offer online child support calculators that utilize Florida’s current guidelines. They’re quick, but sometimes miss details.

Pro se parents should complete the official court worksheet. Judges expect calculations to be done with the current form.

Florida’s child support guidelines include tables that adjust according to the number of children. More income and more kids mean higher support amounts.

Example 1: Combined Income $5,000/month

Example 2: Combined Income $8,000/month

These numbers get split based on each parent’s income percentage. Usually, the parent with primary custody gets support from the other parent.

Costs like daycare or health insurance can adjust these base numbers. The final amount depends on each family’s situation.

Florida judges sometimes order a different amount than what the guidelines say. If they do, they have to explain why in writing.

Common reasons for deviation:

Judges rarely deviate from the guidelines unless there is strong evidence that the standard amount would be unfair. Parents requesting a deviation must demonstrate why a different amount is in the child’s best interests.

The court considers the child’s standard of living and the financial circumstances of both parents. Deviation requests need detailed financial documents and specific reasons.

Many pro se couples overlook tax, Insurance, And Retirement Division Issues That Can Cost Thousands Later.

Hidden financial mistakes in divorce can leave a lasting impact, and most couples don’t realize it until it’s too late. The most common slip-ups involve tax planning, retirement account transfers, and insurance changes.

Most Expensive Mistakes:

Fixing these errors usually costs anywhere from $5,000 to $15,000 after the divorce is final. Some mistakes can’t be fixed after the final judgment.

Tax implications during a Florida divorce can be a surprise to many. Property transfers, filing status, and future tax bills all come into play. Couples often transfer assets without considering the tax implications.

Property Transfer Tax Issues:

Filing status changes can suddenly bump someone into a higher tax bracket. Someone who filed jointly at 12% could jump to 22% as a single filer, even with the same income.

Key Tax Deadlines:

Qualified Domestic Relations Orders (QDROs) let you split retirement accounts without tax penalties. However, if you misfile the QDRO, you may face immediate tax penalties and early withdrawal penalties.

Common QDRO Errors:

Cashing out a 401(k) without a QDRO brings a 10% penalty plus income taxes. For a $50,000 withdrawal, that’s $5,000 in fines and $12,000 to $15,000 in taxes—yikes.

Timeline Requirements:

Joint debts stick around on both credit reports, even after a divorce. The divorce decree doesn’t change what creditors see or remove your name from accounts.

Credit Protection Steps:

High-Risk Situations:

Late payments on divided debts hurt both credit scores until accounts are separated. One missed mortgage payment can drop both scores by 60 to 110 points.

Health insurance for ex-spouses usually ends right after divorce in most employer plans. COBRA provides temporary coverage, but you must sign up within 60 days.

Critical Insurance Changes:

COBRA Details:

To change life insurance beneficiaries, you need to tell the insurance company in writing. Court orders alone won’t automatically update those designations.

Mediation Helps Pro Se Spouses Exchange Disclosures And Reach Property, Alimony, And Child Support Agreements Privately And Cost-Effectively

Mediation in Florida allows people to discuss their disputes with a neutral mediator who guides them toward solutions, but doesn’t make decisions on their behalf.

This setup works exceptionally well for financial issues when pro se couples need help but still want to make their own decisions.

The mediator walks both spouses through the mandatory financial disclosure forms. These include items such as income statements, asset lists, debt inventories, and expense breakdowns.

Pro se couples can become overwhelmed by these forms if they attempt to handle everything on their own.

Property Division Benefits:

For alimony, mediators assist couples in determining fair support amounts based on Florida’s legal factors. They examine income differences, marriage duration, lifestyle, and future earning potential.

This kind of help can save pro se couples from making big calculation mistakes.

When it comes to child support, mediators make sure everyone follows Florida’s guidelines. They help parents plug in the correct income numbers and determine the appropriate support amount.

Mediators also help parents sort out health insurance, daycare, and other kid-related costs.

Torres Mediation focuses on helping pro se couples navigate complex financial matters without the need for a full-time attorney. They step in with extra support tailored for people representing themselves.

Specialized Services:

The firm blends mediation with a bit of legal coaching. Pro se couples get tips on how to file in court and prepare paperwork, but they don’t have to pay for full-on legal representation. It’s a more flexible approach.

Torres Mediation understands that financial concerns often prompt individuals to pursue pro se divorce.

Their mediators truly understand Florida family law and recognize the challenges that self-represented individuals face during financial discussions.

Ready to protect your finances and move forward confidently? Contact Torres Mediation now for a confidential consultation tailored to your Florida pro se divorce.

Do both spouses have to file a financial affidavit in a Florida pro se divorce?

Yes. Florida requires each spouse to file a Family Law Financial Affidavit (Form 12.902(b) or 12.902(c)) within 45 days of filing for divorce. This ensures both parties fully disclose income, assets, and debts before property division, child support, or alimony can be determined.

Can property be divided unequally in a Florida divorce?

Yes. While Florida law presumes a 50/50 split of marital property, courts may order unequal distribution if justified. Factors include one spouse’s economic misconduct, contributions to the marriage, or situations where an equal split would be unfair. Mediation often helps couples reach mutually beneficial agreements without the need for court intervention.

What types of alimony are still available in Florida after the 2023 reform?

Permanent alimony was eliminated in Florida in 2023. Today, only three types remain: bridge-the-gap, rehabilitative, and durational alimony.

Awards depend on marriage length, financial need, and each spouse’s ability to pay. Mediation allows couples to negotiate alimony terms without waiting for a judge’s ruling.

How is child support calculated in a Florida pro se divorce?

Child support is determined using Florida’s Income Shares Model. Courts consider both parents’ gross income, health insurance, childcare costs, and the number of overnight stays. The state provides a calculator to estimate payments, though deviations may apply in cases of special needs, extraordinary medical costs, or high incomes.

Can Florida courts enforce mediation agreements?

Yes. Once signed by both parties and approved by a judge, a mediation agreement becomes a legally binding court order. This means that terms for property division, child support, or alimony reached in mediation carry the same enforceability as if they were ordered directly by the court.

What happens if one spouse hides assets in a Florida divorce?

If a spouse intentionally conceals assets, the court may impose penalties, order unequal distribution, or award additional holdings to the honest spouse. Failure to disclose can also result in contempt charges. Mediation is most effective when both parties are transparent; however, courts will intervene if fraud is suspected.

Do I need a lawyer for financial disclosures in a pro se divorce?

No, but it is risky. While pro se couples can complete and exchange financial affidavits without the assistance of lawyers, mistakes may delay the case or result in unfair outcomes. Many pro se spouses utilize mediation as a cost-effective means to ensure accuracy without hiring full-time legal representation.

How are retirement accounts divided in a Florida divorce?

Retirement accounts, such as 401(k)s and pensions, are considered marital property if they were earned during the marriage or accumulated during the marriage. Division requires a Qualified Domestic Relations Order (QDRO), which the court must approve. Without a QDRO, couples risk tax penalties or lost benefits. Mediation can simplify the valuation and division of retirement accounts.